Managing finances is essential for any business, but it can be complex, especially when it comes to understanding the status of outstanding payments. You've likely come across terms like past due, overdue, and delinquent. While they may seem interchangeable, each term has a distinct meaning and set of implications. This guide will help clarify the distinctions and provide best practices to help you navigate late payment situations with confidence.

What Does Past Due Mean?

Past due refers to an amount of money that has not been settled by its due date. The term applies once the payment deadline has passed, beginning the moment the due date expires without payment being received. For example, if a car payment has a specific date to pay every 5th of the month, it becomes past due on the 6th.

A past due account is typically the first stage of late payments. Financial institutions and businesses use this classification to identify accounts that need attention and collection efforts. It may seem alarming, but it's a gentle reminder to take the opportunity to fulfill the account before more serious consequences arise.

What Does Overdue Mean?

Overdue indicates a payment or obligation that remains unpaid after the established due date has passed. This term is often used interchangeably with “past due,” but overdue is a later stage where the payment has been outstanding for a longer period, exceeding the original terms.

What Does Delinquent Account Mean?

A delinquent account is a payment that is significantly late, beyond its due date. It represents a more serious stage of non-payment and may trigger creditors for aggressive collection actions such as formal notices, legal proceedings, or involvement of collections agencies.

The specific timeframe for a late payment to be reported as delinquent varies by industry and company policy, but it's generally considered delinquent after being 30 to 90 days past due.

Past Due vs Overdue

A past due account refers to any payment that has not been made by its specified due date, even if it’s just one day late. It often results in minor penalties and typically comes with reminder notices.

An overdue account has the same situation as a past due account but involves a longer delay in payment, usually 30 days or more after its due date. It carries stricter consequences like additional fees, interest charges and a negative impact on the credit score.

Overdue vs Delinquent

An overdue account applies to any payment that is well past its due date, but in the early stages of non-payment.

A delinquent account is a payment that is significantly overdue, indicating a more severe stage of non-payment that may lead to service suspension or legal action.

Delinquent vs Past Due

A delinquent account is payment that has remained unpaid for an extended period, generally 1-3 months or more beyond the original due date. It involves more serious consequences and often signals a high-risk situation for creditors.

A past due account is an unpaid amount that has exceeded the payment deadline, starting from one day late. It marks the beginning of the collection process but does not yet indicate the severity of the non-payment.

In Summary

Understanding the differences between past due, overdue, and delinquent accounts is essential for managing your finances effectively. Here’s a quick comparison of the three terms:

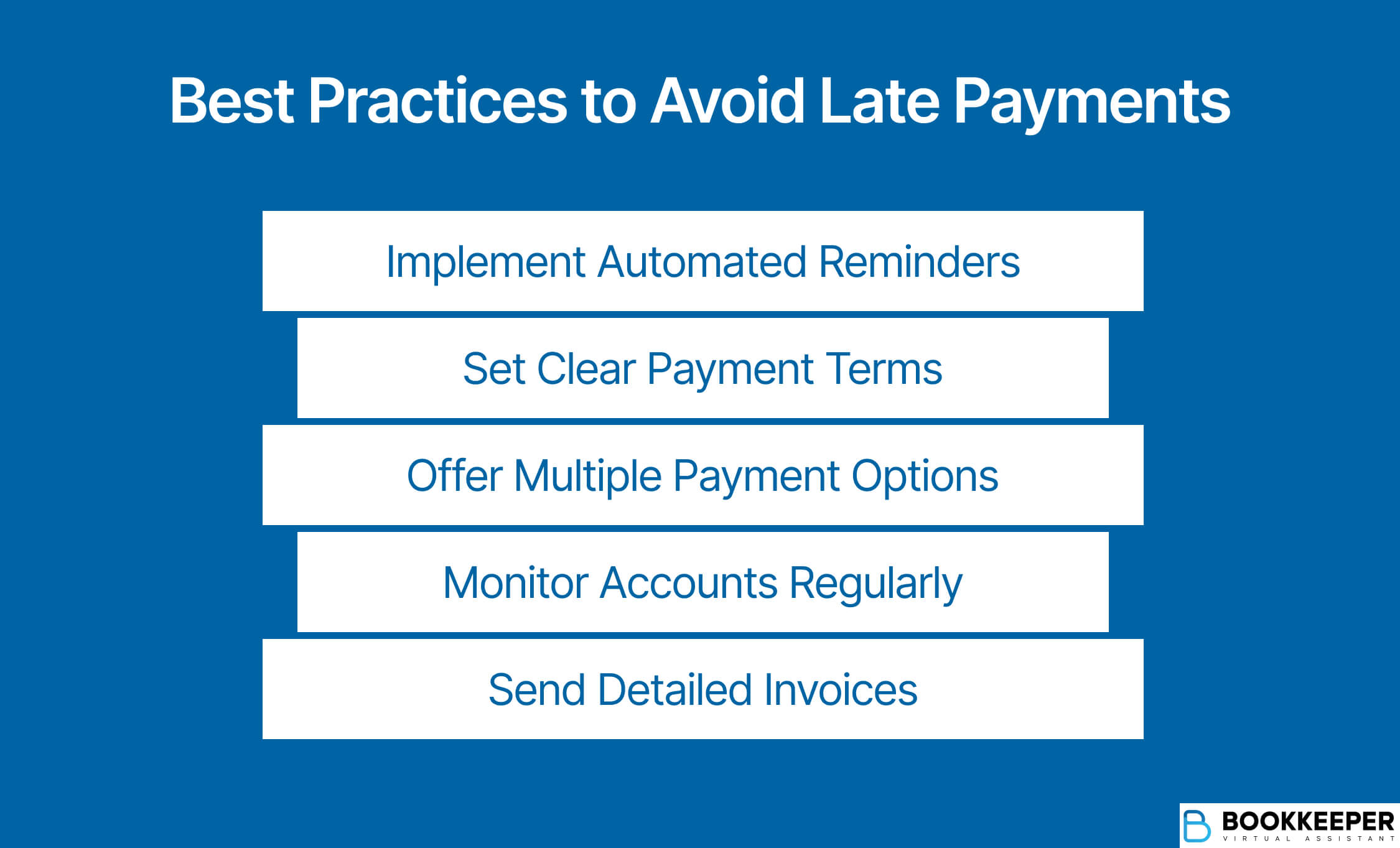

Best Practices to Avoid Late Payments

If you're tired of chasing down payments and spending long hours following up with clients, the solution lies in proactive management and clear communication, all without harming your professional relationships with clients. Here are five practical collection strategies to help prevent late payments:

Automate payment reminders

Use software or tools that send automatic payment reminders before the due date and polite follow-up notices if a payment is missed. This helps keep clients on track and reduces the need for manual follow-ups. Choose a system that fits your business and industry.

Set clear payment terms

Clearly outline due dates, late fees, and accepted payment methods in every contract and invoice. Be upfront and transparent so clients fully understand the expectations from the start.

Consider working with a professional bookkeeper to maintain consistency and enforce standardized payment terms across all agreements.

Offer multiple payment options

The easier you make it for clients to pay, the faster you'll get paid. Offer a variety of payment methods, such as online payments, bank transfers, and credit card processing to accommodate client preferences.

Monitor accounts regularly

Consistently reviewing your accounts receivable helps you identify potential problems early. Regular account reconciliation gives you better visibility into your financial performance and helps maintain healthy cash flow.

Send detailed invoices

Send invoices immediately after delivering a service or completing work. Include all relevant details such as itemized charges, payment terms, and contact info, to build credibility and trust.

The sooner you send the invoice, the sooner your client will be aware of their obligations, increasing the likelihood of timely payments.

How to Politely Ask for Overdue Payment

Begin with a friendly and professional reminder that acknowledges the client relationship and assumes the delay was unintentional.

- For example: “Dear [Client], I hope you’re doing well. I just wanted to kindly remind you that invoice [number], dated [date], appears to be overdue. Please let us know if there’s anything we can do to assist with the payment process.”

Always include all relevant payment details and make it easy for the client to make their payment.

Improving Client Relationships

Late payments don’t have to strain your client relationships. When approached thoughtfully, how you handle overdue accounts can actually strengthen trust.

Tips for strengthening client relationships:

- Communicate payment terms clearly and early in the engagement

- Send friendly reminders politely and consistently to avoid surprises

- Provide professional and responsive customer service support

- Maintain transparent communication from the very beginning

- Offer flexible payment plans or alternative payment methods when appropriate

Focusing on proactive communication and client satisfaction helps turn a potentially difficult interaction into an opportunity to reinforce your professionalism and client-first values.

How a Debt Collection Specialist Can Help

When late payments start piling up or clients become unresponsive, managing collections on your own can quickly become overwhelming and take valuable time away from your core work. It may be time to consider bringing in true specialists who can handle the process for you.

A debt collection specialist can help you:

- Contact clients on your behalf using professional, tactful communication

- Send formal collection notices and reminders to encourage timely payment

- Negotiate payment plans or settlements to recover overdue balances

- Track and manage delinquent accounts, ensuring no invoices are overlooked

- Stay compliant with collection regulations to reduce legal risks

- Keep detailed records of all collection efforts and client communications

With the right specialist, businesses can reduce late payments and improve recovery rates while preserving client relationships.

Frequently Asked Questions

Is past due the same as overdue?

While the terms are often used interchangeably, they refer to different stages of late payment. Past due applies once the payment due date has passed, while overdue generally describes an account that has remained unpaid for an extended period, often 30 days or more.

Can you charge interest on overdue invoices?

Yes, you can charge interest on overdue invoices, but only if your client is legally obligated to pay it. The interest rate and conditions must be clearly specified in a contract, service agreements, or invoice terms that the client has agreed to. Be sure to comply with local laws, as some jurisdictions limit the interest rates you’re allowed to charge.

Does delinquent account get removed on credit record?

Yes, but a delinquent account reported to credit bureaus can stay on your credit record for up to seven years before it’s removed.